2025 Tax Brackets Single Filer. Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much. But what changes every year, based on irs inflation adjustments, is the income ranges for each of those brackets.

How to file your taxes: “for single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025,” the irs tax.

2025 Tax Brackets Single Chart Agnes Steffane, Last year, the irs released adjustments for the 2025 tax year and encouraged taxpayers to look for the standard deduction for single and married people filing, usa today reported.

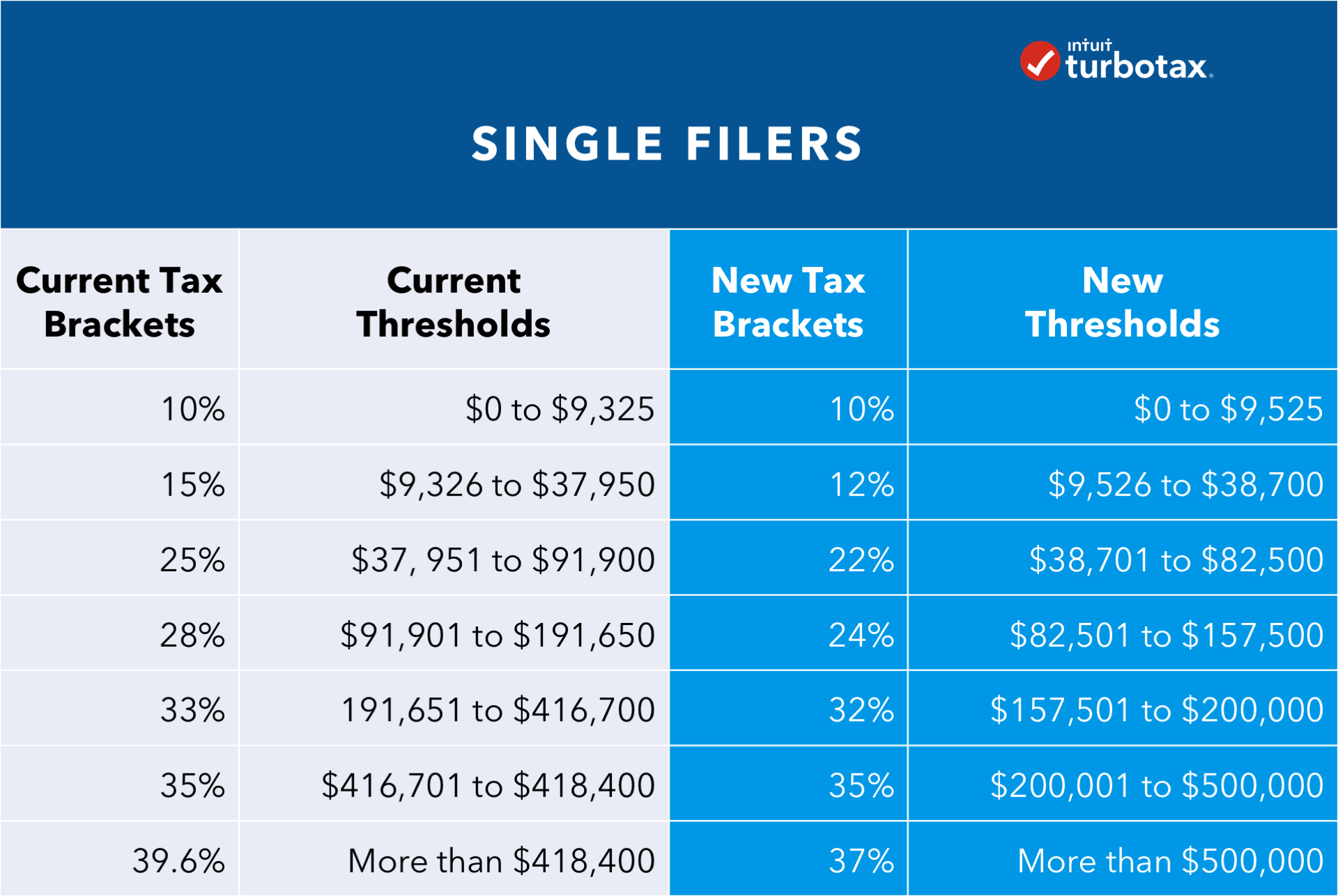

What Are The Tax Brackets For 2025 Single Winni Arabele, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Single Filer Laney Rebeka, As a single filer, the ideal w2 income amount for 2025 is a taxable income of $191,950.

Single Filer Standard Deduction 2025 Idell Jaquelyn, Understanding your tax bill under 2025 irs tax brackets this section dives into some key concepts that are crucial for understanding your tax bill and exploring tax season.

2025 Tax Brackets Single Filing Anne Maisie, Your bracket depends on your taxable income and filing status.

2025 Tax Brackets Single Filer Loise Rachael, But what changes every year, based on irs inflation adjustments, is the income ranges for each of those brackets.

2025 Tax Brackets Single Filer Tool Libby Othilia, The internal revenue service (irs) provides annual inflation.

2025 Tax Bracket Single Filer Ethyl Janessa, The amt exemption amount for tax year 2025 for single filers is $85,700 and begins to phase out at $609,350 (in 2025, the exemption amount for single filers was $81,300 and began to phase.