Ny 529 Limit 2025. If you're a new york state taxpayer and an account owner, you may be able to deduct up to $5,000 ($10,000 if you're married filing jointly) of your direct plan contributions when you. Story by rachel christian • 16h.

One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute. You may contribute to a 529 plan at any time throughout the year, and you do not have to stop.

Essential Plan Ny Limits 2025 Randi Carolynn, Investment returns are not guaranteed, and you could lose money by investing in the direct plan. 529 college savings plans do not have contribution deadlines.

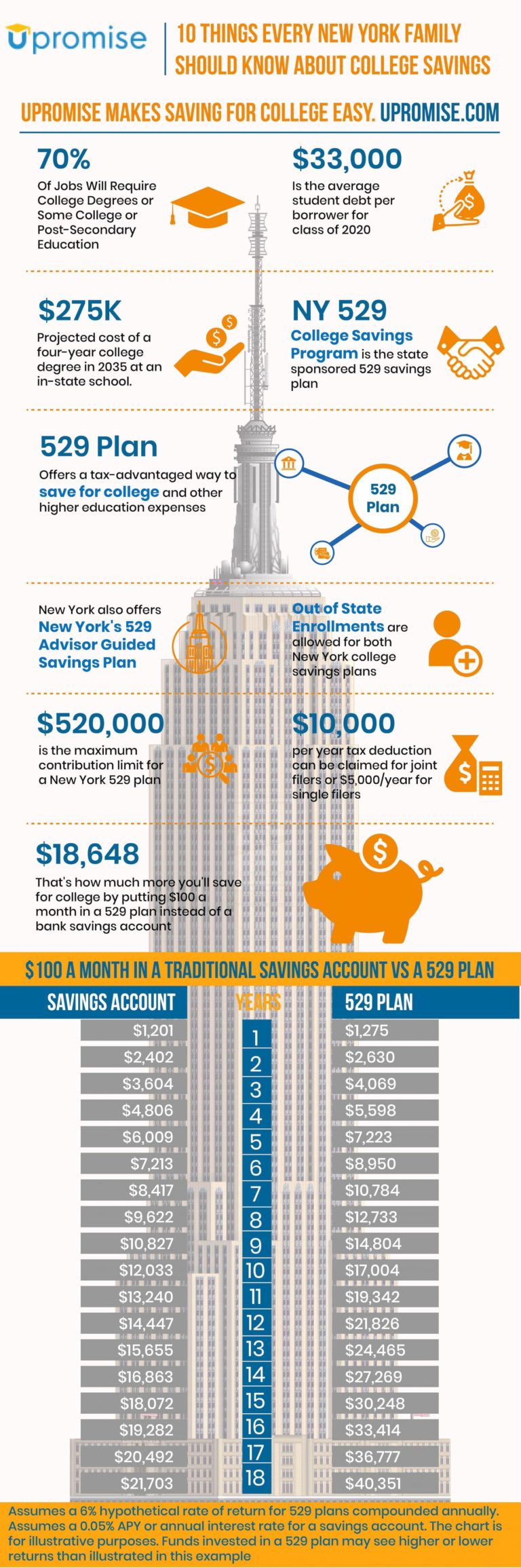

529 Plan New York Infographic 10 Facts About NY's 529 to Know, The maximum allowable transfer for next year will be the contribution limit announced for 2025. Usually, annual contributions to any individual above a certain threshold ($18,000 in 2025, up from $17,000 in 2025) would count against your.

Max 529 Contribution Limits for 2025 What You Should Contribute, Usually, annual contributions to any individual above a certain threshold ($18,000 in 2025, up from $17,000 in 2025) would count against your. If you're a new york state taxpayer and an account owner, you may be able to deduct up to $5,000 ($10,000 if you're married filing jointly) of your direct plan contributions when you.

Medicaid Limits Ny 2025 For Family Of 4 Adey Loleta, A recent change to tax law will. A 529 plan is a product that offers tax breaks to parents saving for college — if they use the tool to nest money for their kids’ educations.

Irs 529 Contribution Limits 2025 Rory Walliw, Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a. Investment returns are not guaranteed, and you could lose money by investing in the direct plan.

NY’s 529 College Savings Webinar Uniformed Firefighters Association, Governor hochul's fy 2025 budget makes record investments in the people of new york while maintaining fiscal responsibility. Story by rachel christian • 16h.

529 Plan Contribution Limits For 2025 And 2025, This is an aggregate contribution limit, meaning the maximum total can be contributed to. Updated 12:37 pm pdt, april 22, 2025.

2025 529 Limit Dore Nancey, The maximum allowable transfer for next year will be the contribution limit announced for 2025. Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Medicaid Limits Ny 2025 Chart Loria Raychel, Usually, annual contributions to any individual above a certain threshold ($18,000 in 2025, up from $17,000 in 2025) would count against your. A 529 plan is a product that offers tax breaks to parents saving for college — if they use the tool to nest money for their kids’ educations.

529 Plan Contribution Limits Rise In 2025 YouTube, Story by rachel christian • 16h. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a.